Tax Deduction Per Mile 2024

Tax Deduction Per Mile 2024 – Taking advantage of these often overlooked tax deductions can help you lower your tax bill. . For the 2023 tax year, deductions for business-related meals If you use your car for business purposes, you can deduct 65.5 cents per mile driven during the 2023 tax year. .

Tax Deduction Per Mile 2024

Source : blog.turbotax.intuit.comIRS Bumps Business Vehicle Tax Deduction to 67 Cents Per Mile in

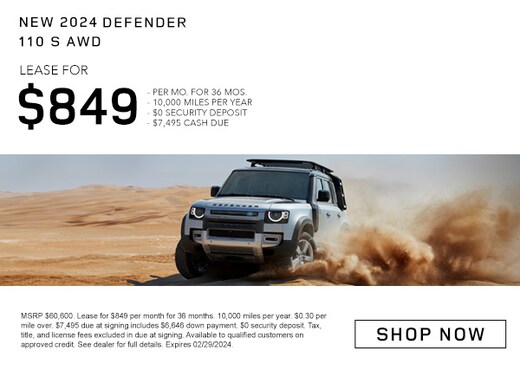

Source : www.theepochtimes.comRange Rover, Defender, Discovery Dealer Cleveland OH | Land Rover

Source : www.landroverwestside.netTaxAce 🚗💼 2024 Vehicle Mileage Rates Update 💼🚗 The IRS

Source : m.facebook.comBusiness mileage tax deduction rate goes up, medical and moving

Source : www.dontmesswithtaxes.comNew Hyundai ELANTRA for Sale in Ontario, CA

Source : www.ontariohyundai.com2024 Honda Civic Lease Deal ($219 Per Month for 36 Months)

Source : www.sloanehonda.comNew Hyundai Hybrid & Electric Vehicles for Sale in Ontario, CA

Source : www.ontariohyundai.comThoroughbred Nissan is a Nissan dealer selling new and used cars

Source : www.thoroughbrednissan.comNew Hyundai Hybrid & Electric Vehicles for Sale in Ontario, CA

Source : www.ontariohyundai.comTax Deduction Per Mile 2024 Self Employed Tax Deductions Calculator 2023 2024 Intuit : Deductions, also sometimes called tax write-offs, are eligible expenses The standard mileage rate for business miles was 65.5 cents per mile in 2023, and it rose to 67 cents per mile in . The tax deduction for moving to a new home was eliminated is a fixed amount of money set by the IRS that you can deduct per mile for business, medical, charitable, and, in some cases, moving .

]]>